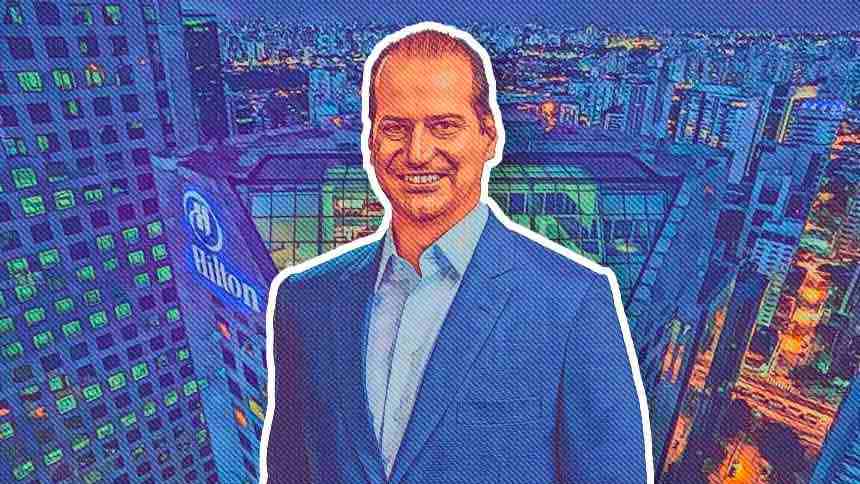

When Marcelo Sampaio entered the world of cryptocurrencies, it was a very dense field. "It was really dense," jokes the co-founder and CEO of Hashdex, an asset management firm that currently has approximately R$ 8 billion under management (this number varies considerably depending on the price of bitcoin and other digital currencies).

The project gained international scale by partnering with Nasdaq, a global benchmark in technology and innovation, creating an index that is a kind of "Ibovespa of the crypto world." "Nasdaq understood the opportunity, checked everyone, and ended up closing the deal with the company from Leblon," says Sampaio, in an interview with Café com Investidor , a NeoFeed program that interviews the leading investors in Brazil.

The index, created in partnership with the American stock exchange, has become a global benchmark, allowing any asset manager to replicate the passive investment strategy in crypto assets. Now, Hashdex is taking a new step.

The Chicago Mercantile Exchange (CME), the world's largest derivatives exchange, has just announced the launch of futures contracts based on the index developed by the Brazilian asset manager in partnership with Nasdaq. "This is game-changing news. Crypto is no longer just Bitcoin or Ethereum; it's an asset class," says Sampaio.

In Sampaio's view, the move is a watershed moment for the sector, gaining legitimacy and opening space for structured products and sophisticated strategies, previously restricted to the traditional market. "The world's largest derivatives exchange is saying: now crypto is relevant, it has its own index and will have futures and options. This definitively institutionalizes the sector," says the co-founder of Hashdex.

The challenge for Hashdex, as well as the entire crypto market, is dealing with the high volatility of its assets. This year, Bitcoin has accumulated a drop of almost 16%. In 12 months, the devaluation is more than 26%. The digital currency's price is above US$73,000, the lowest level since November 2024 – and far from the highest price in history, of US$123,000, in August 2025.

Despite the high volatility, Sampaio argues that crypto is a strategic asset for any portfolio. "The difference between medicine and poison is in the dose. A conservative investor should have at least 5% in crypto in the long term," he states.

Sampaio points out that HASH11 has yielded over 100% and has even fallen by almost 70% at certain times. "Crypto rewards the patient investor very well. Volatility isn't bad; it's a sign that the asset is worth something significant. The opportunity lies precisely in that," he says.

In this interview, which you can watch in the video above, Sampaio explains his thesis, talks about the advancement of regulation in the crypto world, reveals whether he is long or short on Bitcoin at US$1 billion, and responds to criticisms of digital currencies from figures such as Warren Buffett and Jamie Dimon, CEO of JP Morgan.