The Brazilian smartphone market is worth around R$50 billion annually. It remains large, but it's no longer an automatic engine of growth. Currently, it's essentially a market for replacements.

With market penetration nearing its limit and consumers more sensitive to price and credit, selling only new devices no longer guarantees scale or profitability. This means that the number of units sold tends to fall, while the average price rises, driven by the search for more sophisticated models.

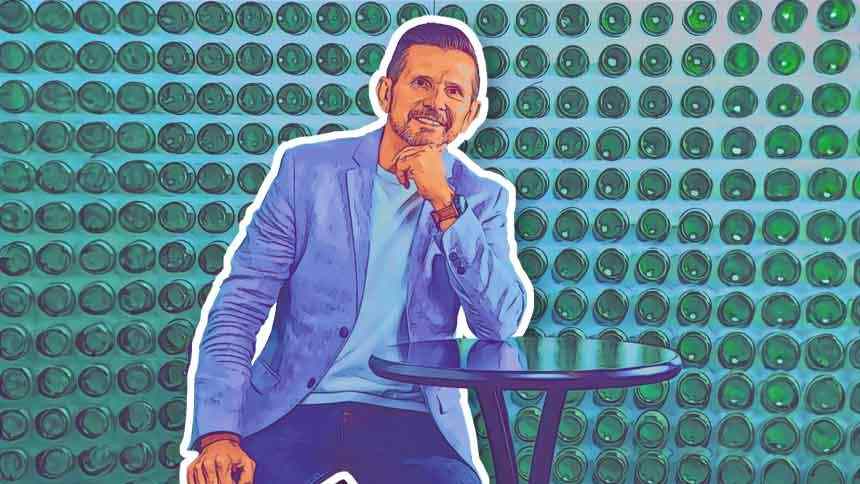

“It’s a stable market in terms of value, but mature. Growth requires going beyond just selling the device,” says Silvio Stagni , CEO of Allied , to Números Falam .

This information helps explain Allied's focus on financial services and partnerships. One of the main examples is the "iPhone for Life" program, developed in conjunction with Apple and Itaú, which allows consumers to pay for the device in installments with the option to exchange it for a new one at the end of the contract.

The initiative not only boosts sales but also fuels a new business: refurbished devices. Using the cell phones returned through these programs, Allied has structured a certified refurbishment operation, now operating under the Trocafy brand.

The thesis is that the Brazilian used goods market tends to migrate from an informal model, between individuals, to a professionalized environment, with guarantees, traceability, and quality standards.

"Cell phones are objects of desire, but not everyone can afford a new product. Refurbished phones broaden access and create a more circular economy," he said on the NeoFeed program.

The figures for the third quarter of 2025 help to understand this strategy. Allied recorded net revenue of R$ 1.4 billion, with growth of 0.6% compared to the same period of the previous year, in line with a market that is advancing little in volume.

The consolidated gross margin stood at 10.7%, stable over 12 months, reflecting mix decisions, renegotiations with suppliers, and the growing weight of services and digital channels.

Operating cash flow totaled R$ 516.6 million during the period, driven by both one-off tax gains and a structural improvement in working capital management.

As a result, the company ended the third quarter with a net cash position equivalent to a negative net debt of 0.7 times EBITDA.

Allied's move also helps sustain margins in a highly competitive sector. By combining distribution, physical retail, digital channels, and services, the company mitigates risks and creates new revenue streams.

“This multiplicity of businesses brings resilience. The company grows, generates cash, and maintains stability even in more difficult cycles,” says the executive.

On the B3 stock exchange, ALLD3 shares have appreciated by 13.9% in the last 12 months. Allied's market capitalization is R$ 758 million.