Few people view Eucatex as a forestry-based company. In the market, the company controlled by the Maluf family is usually associated with wood panels, doors, flooring, or paints.

But it is precisely away from retail and before the factory that the mechanism lies that helps explain the numbers reported in the third quarter by Eucatex - one of the company's most consistent in recent years.

In the third quarter of 2025, Eucatex delivered recurring EBITDA of R$191.8 million, a 26.8% increase compared to the same period last year, with a margin of 24%. Recurring net income advanced 64.6% over the same period of the previous year, to R$84.3 million.

These numbers take on a different dimension when viewed within the context of the strategy being developed: vertical forestry integration, financial discipline, and investment that goes against the grain of the economic cycle.

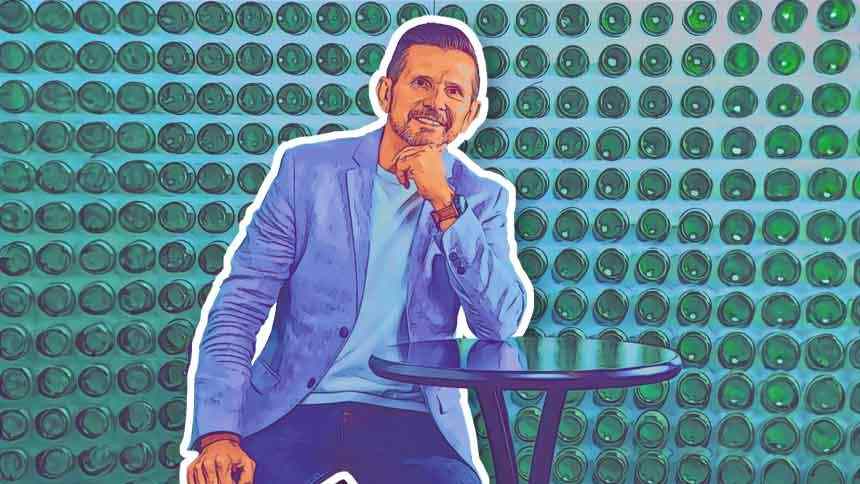

“When we talk about balance, it’s not just about the market or the product. It’s also about risk,” says José Antônio Goulart de Carvalho, executive vice president and director of investor relations at Eucatex, in an interview with Números Falam , a NeoFeed program.

Eucatex currently operates approximately 48,000 hectares of its own forests, all located in the state of São Paulo. In a sector increasingly pressured by competition for timber (especially with the expansion of large pulp and paper players in the Southeast and Midwest regions), this asset functions as operational insurance.

In 2025, the company broke its planting record with 7,400 hectares, and is already planning to expand that number in 2026. The forestry cycle is long: the outlay occurs mostly in the first 18 months, but the return only comes after six to seven years. It is an intensive investment in capital and patience.

“Timber is not like soy. There isn’t a large, liquid market with hundreds of suppliers. Either you have a forest, or you are held hostage by price,” says Goulart de Carvalho.

For Eucatex, self-sufficiency reduces cost volatility, provides predictability to industrial planning, and supports a growth model that is less dependent on favorable cycles.

From the forest to the CRA

The forest base not only protects operations, but it also opens doors in the capital markets. In 2025, Eucatex carried out two issuances of Agribusiness Receivables Certificates (CRA), totaling more than R$ 600 million.

In an environment of high interest rates and scarce credit for the industry, the company managed to strengthen its cash position and extend the maturity profile of its debt without increasing leverage. At the end of the third quarter, the net debt to EBITDA ratio was 0.7 times, even after an intense investment cycle.

“The CRA only makes sense because we are, in fact, a forest-based company. And that gives us a flexibility that is not common in the industry,” says the executive.

With strengthened cash reserves and low leverage, Eucatex accelerated investment at a time when much of the sector is slowing down.

In the first nine months of 2025, capital expenditure (capex) totaled R$ 293.4 million, an increase of almost 30% compared to the previous year. More than half was directed to the forestry segment. The remainder was divided between industrial maintenance and strategic investments.

The most important of these is in the finishing lines – those that transform wood paneling, a commodity, into higher value-added products, such as ready-made doors, partitions, and flooring.

"It doesn't make sense to invest only in the primary line. The gain is in the value chain," he says.

In 2026, the company plans to significantly expand the automation of its door factory, increasing capacity and reducing operating costs. The rationale is to prepare the company now to reap the rewards in 2027, when the macroeconomic cycle begins to turn.

EUCA4 stock has appreciated by 30.1% on the B3 this year, compared to 33.2% for the Ibovespa. Eucatex's market capitalization is R$ 1.7 billion.