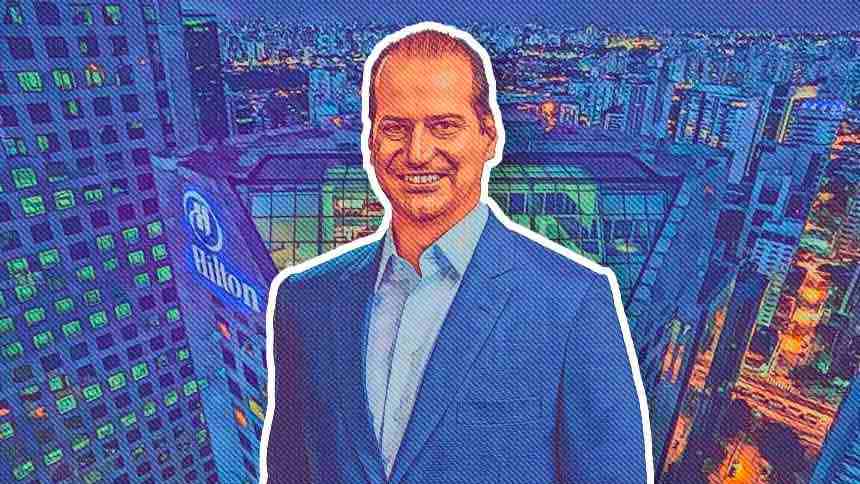

Few investors in Brazil follow Warren Buffett's footsteps as closely as Cesar Paiva, the founder and CEO of Real Investor, a Brazilian firm located in Londrina, in the interior of Paraná, which has R$ 10 billion in assets under management.

So much so that some call him the "Warren Buffett of Londrina" for following the investment guidelines of the Oracle of Omaha, as well as being far from the major financial centers of Brazil, such as Faria Lima and Leblon.

“ Value investing strongly emphasizes the difference between price and value,” says Paiva, on Café com Investidor , a NeoFeed program that interviews leading investors in Brazil. “The adaptation we have to make for Brazil is that the cycles, especially on the macro side, are much more pronounced. I believe you have to demand a greater margin of safety, meaning the price has to be truly attractive to compensate.”

For this reason, Paiva likes to say that his strategy is always to be "selectively opposed" to the market consensus. The tactic consists of finding good companies that are going through a bad time, but that have the fundamentals and ability to reverse the market's negative sentiment.

Three companies in the current portfolio fit this definition: Bradesco, Vivara, and MRV. All of them have experienced problems recently, but are correcting their course and beginning to show good results.

“Bradesco was once trading at 70% of its book value. It was a good company, and we understood that it was correcting its mistakes, which gave us a good opportunity to buy at a good price,” says Paiva. This year, Bradesco's shares have risen almost 50%.

MRV follows a similar logic: a company that was facing problems but was correcting its trajectory. "It's a good example of a company that nobody wanted, whose results were bad, whose stock was cheap, but it was a good company trading at a good price," says Paiva. Its shares are expected to appreciate by more than 50% by 2025.

In the case of Vivara, Paiva says he took advantage of a window of opportunity - the noise surrounding the company's governance, when Nelson Kaufman, the company's founder, suddenly returned to managing the jewelry business.

“The market didn’t like this change, and the shares fell by 20%, 30% in a relatively short period of time,” says Paiva. “It was that moment when we looked at that company that we wanted to be a partner in and that was trading at a very attractive price.” Vivara’s shares have risen almost 80% this year.

In this conversation, which you can watch in the video above, Paiva also talks about Warren Buffett's retirement, says he doesn't believe anyone can replace him, and explains why he's pessimistic about Berkshire Hathaway without Buffett.