Beyond improving operational figures, São Carlos Empreendimentos has been redesigning its business model. The strategy involves asset recycling and the creation of real estate investment funds (REITs), in which the company acts as a significant shareholder, real estate consultant, and property manager.

The first fund was launched in June 2025 with convenience store and street-level retail assets. São Carlos packaged 19 assets from Best Center, totaling 45,000 square meters (m²) of Gross Leasable Area, in partnership with the asset manager TG Core Asset.

The second REIT was finalized at the end of November last year, with the sale of eight properties for R$ 837 million to the SC JiveMauá fund. In total, the company sold almost R$ 1.2 billion in assets to the two management companies.

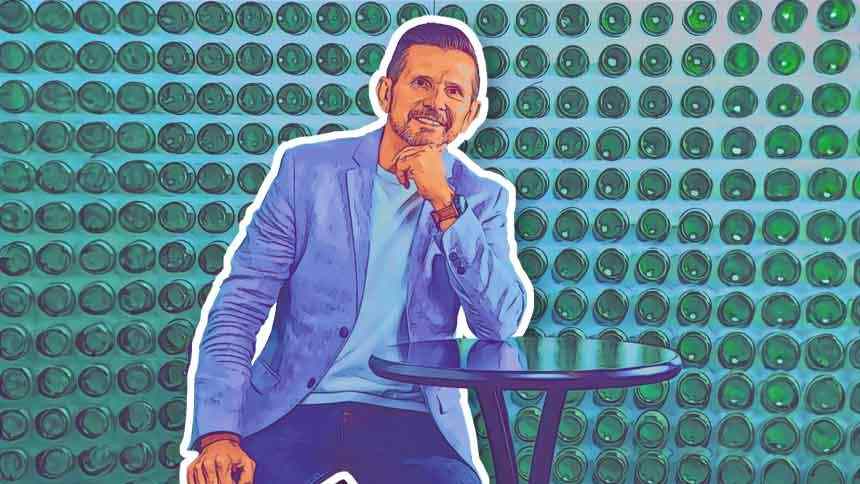

“This model allows us to highlight the real value of properties and creates a new line of recurring revenue for the company,” says Gustavo Mascarenhas, CEO of São Carlos, in an interview with the program Números Falam , from NeoFeed .

The shift to an asset-light company begins to indicate an operational turnaround, after two years marked by high vacancy rates, high interest rates, and a sharp discount on real estate sector stocks on the B3 stock exchange.

In the third quarter of 2025, the company recorded recurring EBITDA of R$ 25.6 million, a growth of 30.9% compared to the same period of the previous year, driven by higher occupancy rates in its properties and more rigorous cost control efforts.

"The growth reflects a combination of increased occupancy and operational efficiency," says the CEO of São Carlos.

With a portfolio concentrated in corporate buildings in São Paulo and Rio de Janeiro, São Carlos currently operates with a vacancy rate of around 10%, practically half the market average, estimated at around 20%.

Part of this performance comes from the Flex Office model, in which spaces are tailored to the tenants' needs. This strategy has helped accelerate net absorption, which totaled approximately 7,000 m² in the last 12 months.

A key milestone of the quarter was cash generation. São Carlos reported a positive FFO – cash flow generated by core operations – of R$ 900,000 in the period. This is the first result in this category since the fourth quarter of 2022.

Although still modest in absolute terms, the number symbolizes the combination of operational improvement and financial restructuring of the company, which now has a more robust cash position after the sale of assets and the prepayment of more expensive debts.

“It’s a turning point. It shows that the company has started generating operating cash flow again,” says Mascarenhas.

SCAR3 stock has fallen 14.4% in the 12 months leading up to January 20th of this year. São Carlos' market capitalization is R$ 783.5 million.