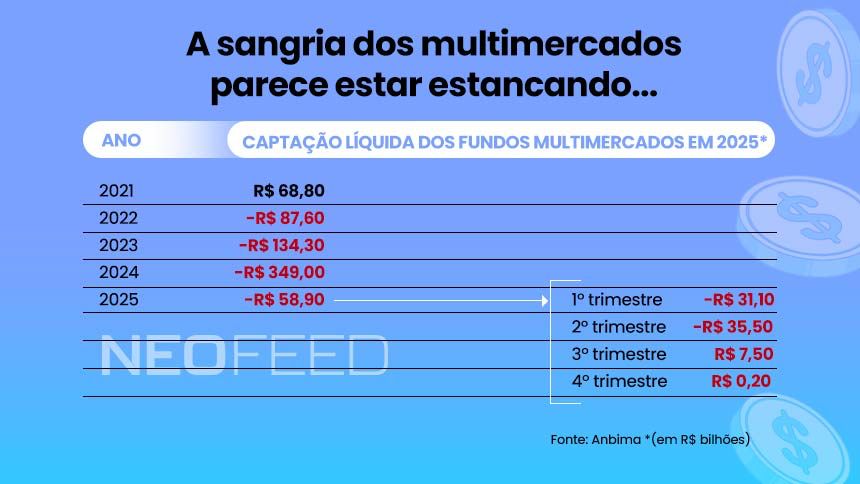

After three years of billion-dollar redemptions, the market believed that the bleeding of multi-asset funds had finally stopped. In 2025, withdrawals decreased and the second half of the year brought positive inflows. But a deeper dive into the data shows that the recovery did not come for independent asset managers.

While banks and wealth management structures have started raising capital again, independent multi-market asset management funds continue to lose money – and market share – in investors' portfolios.

What the data shows is an uneven recovery in fundraising, which is not necessarily linked to the performance and delivery of results by managers.

At the request of NeoFeed , Outliers Advisors, a consultancy specializing in the asset management market, analyzed the net inflow of the asset class in 2025 based on Anbima's figures. The objective was to separate the effect of exclusive funds, widely used by wealth management structures, from the performance of asset managers.

According to Samuel Ponsoni, partner at Outliers Advisors, most exclusive funds use the "multi-market investment abroad" classification, which offers greater flexibility for international allocations and alternative assets. Traditional multi-market managers, on the other hand, operate predominantly in the "local multi-market" category.

In 2024, both segments experienced significant redemptions, reinforcing the argument that the end of the tax benefit of the "come-cotas" (a Brazilian tax incentive for fund redemptions) accelerated the dismantling of exclusive funds, exacerbating redemptions from multi-market funds. In 2025, however, the scenario reversed.

While the segment of investment abroad recorded net inflows of R$ 41 billion, local multi-market funds - excluding capital-protected funds and including pension funds - had net redemptions of R$ 102 billion ( see tables below ).

“There is no classification today that clearly separates wealth from assets, but this distinction helps to understand the trend. The numbers show that the crisis in multi-market funds has not yet bottomed out,” says Ponsoni.

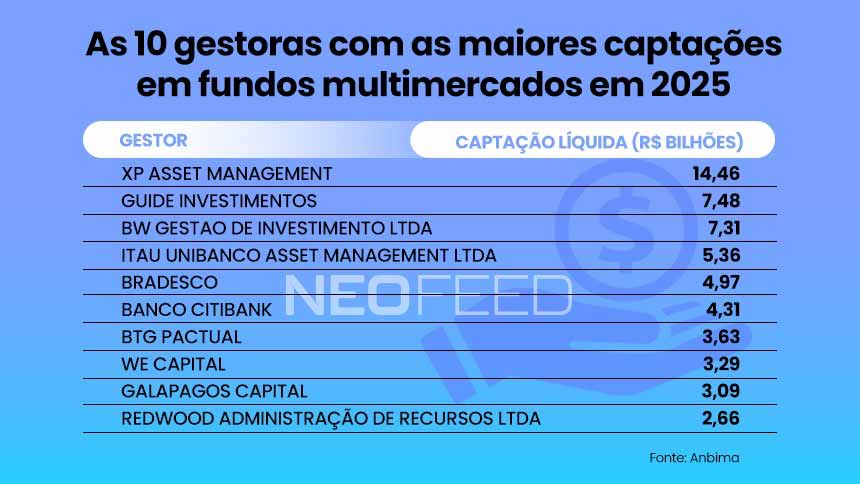

The contrast is also apparent when looking at the ranking of asset managers. Among the 25 firms that raised the most capital in multi-market funds in 2025 – a total of R$76 billion – only nine operate exclusively as asset management firms. The majority combine wealth management structures or both activities.

Among the 25 asset managers with the largest redemptions, totaling net outflows of R$ 91 billion, independent asset management firms predominate.

Among the biggest redemptions of the year are traditional names in the industry, such as Western Asset, Absolute , Gávea Investimentos, Legacy, Ibiuna, SPX , Verde and Clave, in addition to Reag Investimentos, which is involved in investigations related to Operation Hidden Carbon.

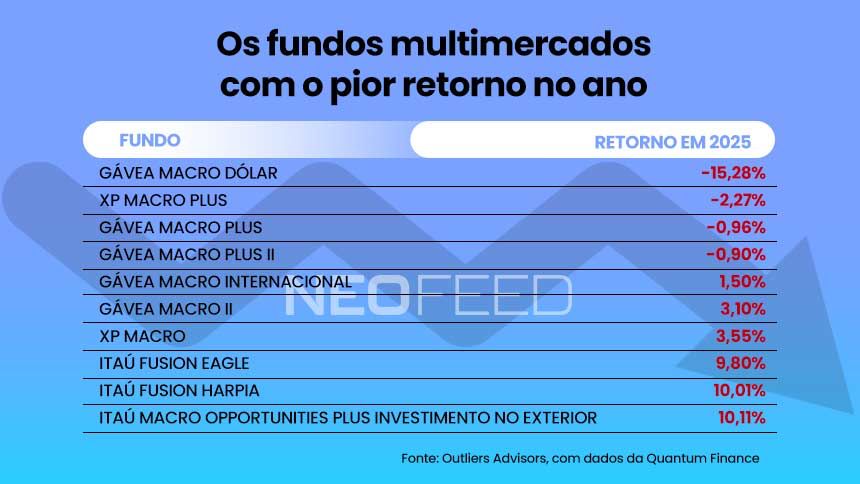

A significant portion of these asset managers' main funds underperformed or were very close to the CDI rate of 14.3% during the period, with returns ranging from 10% to 13%. Others were only marginally above the benchmark.

Contacted for comment, Absolute, Legacy , Ibiuna, SPX, and Verde declined to comment. Clave ceased to exist after being acquired by BTG Asset Management at the end of 2024.

In a statement, Western Asset said that the volume of multi-market funds is not very representative of its operation and that the redemptions mainly reflect the restructuring of an institutional mandate, without any withdrawal of assets from management.

Gávea Investimentos attributed the redemptions to weaker performance in 2025, after two years of strong fundraising driven by above-average returns. Last year, some of its main funds recorded negative performance, such as the Gávea Macro Dólar (-15.28%).

Since 2022, multi-market funds have accumulated net redemptions of more than R$ 790 billion, according to data from Anbima. Last year, withdrawals totaled R$ 58.9 billion, one-sixth of the amount recorded in the previous year, when outflows totaled R$ 349 billion.

Banks advance

Among the three largest net redemptions of the year are two financial institutions: Banco do Brasil and Santander – Reag leads the list with an outflow of R$ 10.3 billion. This reflects the size of asset managers, who consolidate investment funds, institutional mandates, and private banking structures.

At Santander, the dismantling of exclusive funds still had a significant impact, but the asset manager also promoted internal changes to strengthen its portfolio, with new hires, greater synergy with the global asset management arm, and the launch of new strategies, such as those that use systematic models.

“This is a time of low interest in the asset class, but historically it is when the best opportunities arise to invest in teams and products,” says Renato Santaniello, head of global multi-asset solutions for Latin America at Santander.

Banco do Brasil, in turn, highlights that institutional rebalancing movements have reduced exposure to the asset class, regardless of the performance of specific funds - some of which have returns above the CDI (Brazilian interbank deposit rate) in 2025.

According to the BB's management, the portfolio has undergone extensive reorganization in the last two years, with a reduction in overlaps, improvement of risk models, investments in technology, and reinforcement of teams.

On the other hand, among the ten largest net inflows of the year are institutions without asset management operations, such as Citibank and family offices like BW Gestão de Investimentos and We Capital.

Other firms combine wealth management and asset management, such as XP Asset, Itaú Asset , Bradesco Asset, BTG Asset, and Galapagos Capital . Among the major fundraising firms, only Redwood operates exclusively as an independent asset manager.

“The movement makes it clear that the wealth management industry recovered first, not the multi-market funds themselves,” says Ponsoni. “Within the asset management sector, the banks were the big winners.”

What's next?

All the asset managers NeoFeed spoke to are optimistic about a market turnaround this year. The strongest reason is the expectation of a drop in the Selic rate starting in March, as indicated by the Copom (Monetary Policy Committee) in the minutes of its first meeting of 2026. With this, investors are expected to turn more towards riskier assets.

But allocators understand that profitability also needs to come, and consistently. In the last 12 months, the Anbima Hedge Fund Index has accumulated a 17.3% increase, above the CDI of 14.6%. However, over a 24-month horizon, it still remains below the benchmark.

A survey by Outliers Advisors shows that, in the last five years, less than 20% of the main multi-market funds managed to outperform the CDI (Brazilian interbank deposit rate).

“It’s true that there has been a lot of competition with tax-exempt assets, but it’s also true that multi-market funds haven’t had good profitability windows in the last five years. And one year of good results isn’t going to change that image,” says Ponsoni.

In addition to competition from tax-exempt products, a significant portion of investors' capital remains locked in fixed-income securities until maturity. The election scenario also adds uncertainty, with a potential impact on the pace of interest rate cuts and risk appetite.

In this environment, the market consensus is that 2026 may be less adverse – but still far from representing a structural turnaround. Recent moves, such as Vinci's entry into Verde and BTG's purchase of Clave, indicate that industry consolidation should continue.

“There doesn’t seem to be a clear reversal of investor sentiment towards the asset class. In the best-case scenario, outflows should simply stabilize,” assesses Ponsoni. “And this tends to maintain the consolidation process.”

After a decade of prominence, multi-market funds are undergoing a silent transition. The asset class hasn't died, but while independent asset managers are still struggling to regain profitability and relevance, banks and wealth management structures are advancing, occupying the space left by the crisis.