“Surreal!” That’s how Luana Lopes Lara describes the news of becoming the world’s youngest self-made billionaire—without inheriting her fortune. On Tuesday, December 2nd, the startup she co-founded in New York, Kalshi, received a US$1 billion investment, led by Paradigm and with participation from Sequoia Capital, Andreessen Horowitz, Meritech Capital, IVP, ARK Invest, Anthos Capital, CapitalG, and Y Combinator.

With this, Kalshi was valued at US$11 billion, which allowed the 29-year-old from Minas Gerais to join the club that only 0.000038% of the global population has access to, with an estimated fortune of US$1.3 billion. “I attribute a large part of Kalshi's success to the persistence in the face of all adversities and the resilience we have demonstrated over many years, never giving up,” says Luna, who created the startup alongside Tarek Mansour, in an interview with NeoFeed .

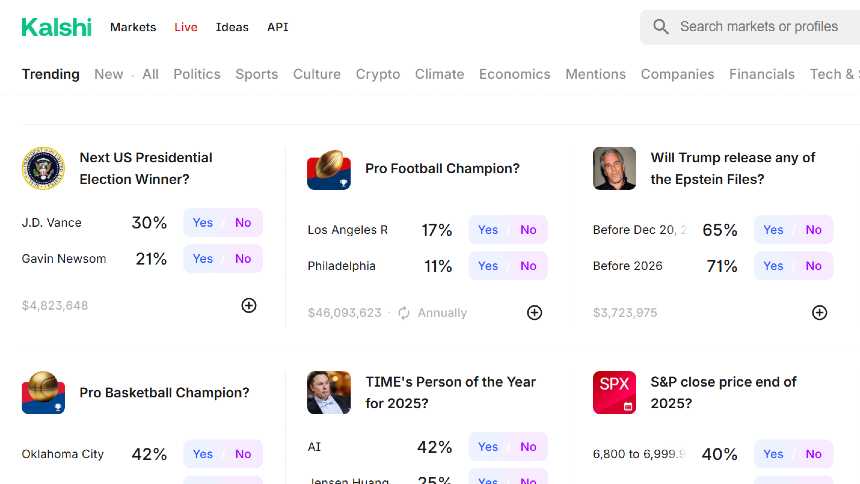

Founded in 2018 in New York, Kalshi operates an exchange where, literally, the future is traded. Economics, politics, finance, culture, sports, science, climate—not surprisingly, kalshi , in Arabic, means "everything." The startup poses specific questions about a given subject and creates a market: "Oscar for best actor? Timothée Chalamet? Leonardo DiCaprio? Wagner Moura?", for example.

For each question there are only two possible answers: “yes” or “no” — the so-called event contracts, the new asset class created by Luana and Tarek. Every position is traded between US$0.01 and US$0.99. Whoever correctly predicts the outcome receives US$1 per contract. Whoever is wrong, loses everything.

The price of a "future" indicates, in practice, the chance of it actually happening. An event traded at US$0.63 has a 63% probability of occurring. Thus, the platform created by the duo functions as a collective thermometer, where the price reflects the expectations of the majority of investors.

Luana and Tarek studied together at MIT in the United States, where they graduated in computer science. During their undergraduate studies, they took advantage of summer vacations and internship programs to work at some of the biggest firms on Wall Street — she at Bridgewater Associates and Citadel Securities, he at Goldman Sachs.

“As traders , we saw people making trades based on what they thought would happen with Brexit or Trump's election, for example,” says Luana. “We wondered: what if people could trade based on the outcomes of these events, like trading stocks in the financial markets?” From this curiosity, Kalshi was born.

Between the innovative idea and the start of operations, however, almost two years passed—a year of considerable risk-taking and tension. But the partners were determined: the project would only move forward with the approval of the federal government. In November 2020, the approval finally came. And Kalshi became the first fully regulated stock exchange to operate with futures event results in the United States.

The caution paid off. Their main competitor, Polymarket, was fined US$1.4 million in 2022—two years after its founding—for promoting unregistered marketplaces.

Last September, Kalshi made history again. At Luana's initiative, the company filed a lawsuit against the government and won, for the first time in over a century, the right to offer contracts for election events. The request had been denied in September 2023.

“Many doubted our decision,” he recalls. “But I fought for it.” He did well. In the November 2024 presidential election, Kalshi investors moved more than US$500 million. And, most importantly, they predicted Donald Trump's victory over Kamala Harris.

Since then, the company has only grown. In less than two months, its valuation went from US$5 billion to its current US$11 billion. 2025 was definitely Kalshi's year. In just the first 18 days of September, the startup moved US$1.3 billion, giving it more than 60% of the projected market volume, according to The Block , a website specializing in digital assets.

And what about the new partners? Only major allies — Elon Musk's xAI; the StockX marketplace and the National Hockey League, just to name a few. The company has also been integrated into the Google Finance system and the Robinhood and Webull investment platforms.

Luana attributes much of her discipline and focus to her time as a professional classical ballerina. After finishing high school, she graduated from the Bolshoi Theatre School in Brazil, the only one outside of Russia. And, for nine months, she was a member of the ballet corps of the Salzburger Landestheater in Austria.

Back then, she would dance for seven or eight hours a day. Often, teachers would hold a lit cigarette next to her thigh to see how long she could keep her leg raised above her ear without burning herself, reports Forbes magazine.

In 2013, however, Luana traded her ballet shoes for mathematics. The Lara family has a knack for the exact sciences—her mother is a mathematics teacher, her father an engineer, and her older sister has a PhD in industrial engineering. Luana, even as a child, became champion of the mathematics and astronomy and astronautics olympiads.

When applying to American universities, she was accepted to Harvard, Stanford, and Yale, but chose MIT—more than the others, Massachusetts would take her out of her comfort zone, she justified at the time. Thanks to a scholarship from the Educar Foundation, created by Jorge Paulo Lemann, Marcel Telles, and Beto Sicupira, she graduated in computer science.

The young woman may be a billionaire, but, as she says, "at Kalshi, the work continues as always — we still have a lot to accomplish." She wakes up at six in the morning and goes to the company, where she stays until late afternoon. In her free time, the fan of historical documentaries loves to travel and discover new restaurants with her fiancé and friends.

Below are the main excerpts from Luana's email interview with NeoFeed .

Ah… before we proceed, it's worth noting that on the morning of Sunday, December 7th, the probability of the "Best Actor Oscar" market closing with a "yes" for Wagner Moura was only 10% — third position after Chalamet and DiCaprio.

What differentiates Kalshi from a betting house?

People often lump prediction markets and casinos together. But they're not the same thing. At Kalshi, you trade with other people, not against the house. This means that if you lose, the house wins. At Kalshi, we are more transparent and fairer—less exploitative.

Where do you make your money?

We make money the same way most brokers do: we charge transaction fees on all trades.

If forecasting markets are still relatively unknown today, I can only imagine what it was like seven years ago. Where did the idea to work in this field come from?

As traders , we saw people making trades based on what they thought would happen with Brexit and Trump's election, for example. Many trades were based on opinions about future events. Complex financial packages at a high price. But these packages were just indicators: basically, a set of risk curves combined to approximate binary exposure to the event.

What is the difference compared to what Kalshi does?

It wasn't possible to trade the event directly, although that would have been simpler and cheaper. One night, during an internship on Wall Street, while we were walking home, the idea finally came to us: "What if people could trade based on the outcomes of these events, like trading stocks in the financial markets?"

Kalshi was founded in 2018, but only started operating in 2020. Why the delay?

We faced significant challenges along the way, but that only made us more determined to pursue success. Obtaining regulatory approval was a key objective for Kalshi from the very beginning. It took time to legalize forecasting markets for real-world events. It was an unprecedented achievement. Then, we sued the government to allow the entry of election-related markets into Kalshi.

What happened?

We sought permission from the CFTC [Commodity Futures Trading Commission] to offer election event contracts. The CFTC, however, expressed concerns about potential manipulation and impacts on election integrity, leading to the rejection of Kalshi's proposal. Many doubted our decision to sue the government, but I fought for it. And in 2024, just before the U.S. presidential election, we won.

Is it true that her years as a ballerina were the most intense of her life?

Ballet demanded a lot of sacrifice and discipline. The routine was exhausting. I danced for hours. In addition, I had to move to southern Brazil [the Bolshoi school is in Joinville] and be away from my family. But I was doing something I loved.

What was the influence of your parents on your choice of mathematics?

They raised my sister and me with the belief that we could do anything we wanted. My family taught me to believe in myself. And that gave me the confidence to forge my own path from a young age. That's what led me to become a dancer and, later, to found Kalshi. Nothing is "too crazy." You don't want to look back and discover you wasted all your potential.